To begin with, we have all heard the phrase YOLO. For years, “You Only Live Once” was the ultimate excuse to hit the “buy now” button. In the fast world of 2026, this mindset has become easier than ever to follow. With a single glance at your phone or a quick tap of your wrist, […]

Read more

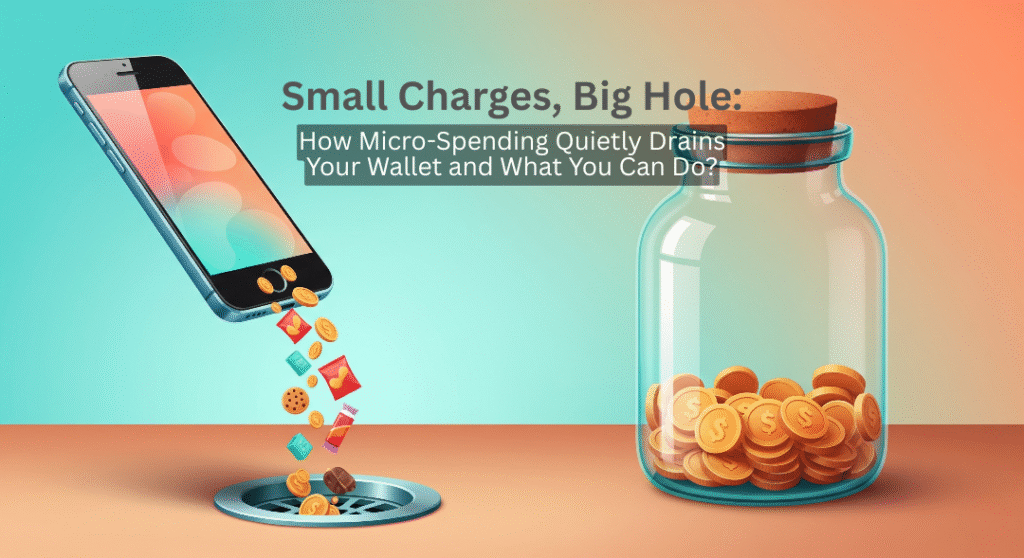

It is the first week of the month. Your salary just hits your account, and you feel like a king for exactly five minutes. Then, the “ping” sounds start. Ping! Your music streaming renewed. Ping! That AI photo editor you used once for a cousin’s wedding took its monthly cut. Ping! A news site you […]

Read more

In 2026, the world moves at the speed of thought. We pay with a tap of a smart ring, a glance at our phone, or even a palm scan at the checkout. Buying something online often means a single click, thanks to saved card details and biometric verification. These innovations promise to simplify our lives, […]

Read more

Happy New Year! A new year brings new energy and fresh financial goals. Perhaps you received a nice salary raise recently. Maybe you started a better job this January. You should feel wealthier now. However, many people notice something strange. Their bank accounts still look empty at the end of the month. This happens because […]

Read more

Managing money does not have to feel confusing or stressful. In fact, it can be as simple as doing a small checkup once a month. Just like a health check helps you understand your body better, a financial health check helps you understand your money habits clearly. Many people create a budget and forget about […]

Read more

Do you ever wonder where your paycheck goes? It seems to disappear too quickly every month. We often try to save money but struggle to be consistent. This is a very common financial problem today. You are certainly not alone in this struggle. Fortunately, there is a simple and powerful answer. It is called financial […]

Read more

Freelancing, content creation, consulting, gig work-modern careers are more flexible than ever. You choose your projects, manage your time, and sometimes even work from anywhere. But there’s one thing you don’t get: a predictable monthly income. One month can be packed with work, while the next feels painfully slow. Payments get delayed, clients cancel, and […]

Read more

Many people start planning their trips when December arrives. The holiday season creates a strong wish to explore new places. Families look for good destinations. Friends plan fun trips together. Everyone hopes to enjoy a memorable travel experience. However many people struggle with travel expenses. Costs rise faster than expected. Simple mistakes can affect the […]

Read more

Managing personal finances feels hard for many people today. Prices keep rising and unexpected costs appear without warning. Because of this, many people search for simple methods that offer more control. One method that works well is using sinking funds. Another helpful method is the sinking debt strategy. Both ideas support better money management and […]

Read more

Budgeting has become very important in 2025 because spending habits change fast. Many people want simple methods that help them stay mindful. Cash stuffing and digital tools are now two popular choices. Each method offers a different way to control money. People often wonder which style supports better discipline and long term habits. Both systems […]

Read more

Have you ever wondered where all your money goes? You look at your paycheck, pay the major bills, and then – poof – the money seems to vanish. It’s a frustrating experience that leaves many people feeling stuck. You might be financially responsible, yet your bank account balance never truly reflects your hard work. This […]

Read more

The world of personal finance has never been easier to navigate, yet somehow, it’s never felt more stressful. We carry supercomputers in our pockets, capable of executing global financial transfers in seconds. Yet, this very convenience-this “frictionless finance”-has become the single greatest threat to our financial stability and mental peace. In the past, debt involved […]

Read more

A mortgage loan is often the biggest financial responsibility many people take in their lifetime. It provides stability, yet also brings long-term obligations. For many families, the monthly payments become a constant reminder of the years ahead. The thought of paying interest for decades can feel overwhelming and limiting. Fortunately, with some planning and discipline, […]

Read more

You tap, pay, and hardly notice. A small UPI transfer here, a ₹30 tea there, a trial that quietly renews – each spend feels tiny on its own. However, when these tiny flows combine every day, they create a steady leak in your monthly finances. Over time, that leak can stop you from saving for […]

Read more

We have all been there. A weekend of fun, online shopping, or unplanned dining out can quickly drain our wallets. At first, it feels good, but later regret sets in when bills arrive. That is when the idea of “revenge saving” comes into play. This trend is gaining popularity as people look for balance after […]

Read more

Are you noticing that your money doesn’t stretch as far as it used to? Indeed, many people are feeling the increasing pressure at the checkout and in their monthly bills. This is largely due to inflation and the steadily rising cost of living. However, feeling helpless is not the only option. This blog post aims […]

Read more

Hey, let’s talk about Buy Now, Pay Later (BNPL) – the payment trend that’s taken 2025 by storm! With the global BNPL market hitting $560.1 billion and over 91.5 million Americans using services like Klarna, Afterpay, and Affirm, it’s no wonder why everyone’s jumping on board. Splitting that new laptop or vacation package into bite-sized […]

Read more

Do you ever scroll through social media? You see something fantastic. Perhaps it is a new gadget or a trendy outfit. The urge to buy it often hits immediately. This feeling is the “instant gratification trap.” Modern life, especially digital platforms, makes us expect instant rewards. This mindset often leads to impulsive decisions. A big […]

Read more

The enticing scent of coffee, fresh from your beloved local cafe. The ease of a quick takeaway lunch after a long day. The special moments of dining out with cherished people. Eating out is an enjoyable aspect of modern living. However, for many of us, this ordinary pleasure is often accompanied by a sense of […]

Read more

Life is full of unexpected twists and turns. While we all hope for smooth sailing, the reality is that financial curveballs can come out of nowhere – a sudden job loss, an unforeseen medical emergency, a major car repair, or a burst pipe at home. Without a safety net, these events can quickly derail your […]

Read more

Payday feels like a burst of financial freedom, but it’s a slippery slope filled with spending temptations that can throw your budget off course. From impulse purchases to sneaky debt traps, it’s easy to lose control without a plan. Enter Dollarbook, a powerful money manager app, designed to help you navigate payday with ease. With […]

Read more

Key Points Payday Planning: What to Do With Your Salary on Day One Payday is a golden opportunity to take control of your finances and set the stage for financial success. By strategically managing your salary with tools like Dollarbook, a leading money manager app available at Dollarbook.app, you can cover immediate needs, reduce debt, […]

Read more

Crushing debt can feel like an uphill battle, but with the right tools, you can turn the tide in your favor. Enter Dollarbook, a powerful money management app designed to help you track expenses, budget smarter, and achieve financial goals. Whether you’re juggling credit card balances, student loans, or medical bills, Dollarbook can streamline your […]

Read more

What if taking control of your money was as simple as tracking a few daily expenses? Developing the habit of tracking your spending can transform your financial life, turning confusion into clarity. In this blog, we’ll explore how consistently logging expenses is a game-changer and how Dollarbook – an easy, cross-platform expense tracking app (available […]

Read more

Have you ever wondered why money seems to disappear faster when using a card? The way we spend is deeply influenced by psychology. When you hand over cash, you physically see the money leaving your hands. This creates a sense of loss, making you think twice before spending. On the other hand, swiping a card […]

Read more

Managing finances effectively requires a clear understanding of assets and liabilities. These two elements shape personal and business wealth, influencing financial stability. While assets add value, liabilities create obligations. Knowing the difference helps individuals and businesses make informed financial choices, ensuring long-term growth and security. Many struggle with financial planning because they fail to distinguish […]

Read more

Do you ever wonder where your money disappears every month? Bills, groceries, unexpected expenses-it all adds up fast! Without a proper tracking system, managing finances can feel like an endless struggle. But what if you had a smart assistant to handle it all? An expense manager app is your financial lifesaver! It helps you track, […]

Read more

Managing money can feel overwhelming, but an expense manager app makes it easier. These digital tools help track spending, budget effectively, and analyze financial habits. Instead of guessing where your money goes, you get real-time insights into expenses. With categorized spending, automated calculations, and reminders, managing finances becomes stress-free. It’s like having a personal finance […]

Read more

In today’s busy world, keeping track of finances effectively is more crucial than ever. With increasing expenses and the need to save for future goals, keeping track of where your money goes can be overwhelming. Money management apps have become an essential tool for many individuals seeking a more organized approach to their financial life. […]

Read more